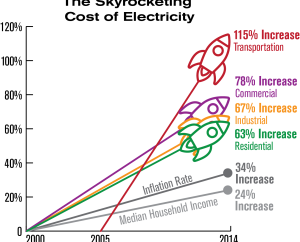

TXU Energy, the most important energy store in north Texas, stated Wednesday they are bringing down their rates for the clients. TXU Energy spokes girl Sophia Stoller stated, that the TXU electricity rates were, 15.9 pennies every kilowatt-hour for utilization of 1,000 kWh a month. The price will drop by 7% on average, but a few will drop as lots as 15%.

Texas’s 2nd biggest energy store, Reliant Energy , based totally out of Houston, has rolled out comparative enhancements in May and June. They delivered down their charges as much as 20%.

However, despite these decreases, clients can also as yet take a look at decreased rates by way of searching out the pleasant arrangement for what they need.

Conocophillips has revealed that they have lost 76% of their benefit. They are the subsequent significant oil to report comparative losses in two days. They are saying that at some point in recent years the autumn in gas prices and terrible refining effects is the justification for their 2nd sector defeat.

Surety Financial Group Inc, the second-largest public bank in Texas, stated they will possibly fall after credit score misfortunes and compose downs left them shy of capital. One supply, mentioning to stay mysterious, because the gatherings areas but being kept thriller, stated the Financial Group is talking to something like one economic backer accumulating for an ability recapitalization. Assuming Guaranty Financial Group had been to bomb they could be the most important US Bank to implode in 2009. In such an extended way there had been 64 banks bombed this year remembering seven for Friday. Surety does not assume elevating sufficient money to satisfy the April order to close everything down from the government office of frugality management.

The monetary movement inside the Feds Dallas locale, which includes Texas and portions of Louisiana and New Mexico, “Remained for the maximum part consistent at stifled stages in June and early July.” A Federal Reserve depiction of the financial instances given Wednesday confirmed that most of the people of the Feds 12 regions have been starting to shed the downturn or the district is starting to balance out, no matter whether or not is at touch addition. However the economic system truly is delicate, the truth remains that a part of the Fed’s locales gives amazing symptoms of beginning to balance out. These signs carry trust that this downturn may additionally ultimately be attracted to a close-by.

U.S. Work Market Tighter than Texas

While work markets are solving in Texas, the U.S. Circumstance is surely tough. The Texas joblessness rate tumbled to five.6 percent in September from 5. Nine percent in August, and the body of workers extended to a three.3 percentage annualized tempo-a excessive for the 12 months. The U.S. Group of workers declined by a 1. Four percent charge. Regularly, it increments when workers have a greater agreeable outlook on their possibilities within the paintings marketplace; an excessive stops charge demonstrates a moderately massive variety of employment opportunities consistent with experts and a decent work market.

This movement is via and huge higher in Texas than in the U.S. In light of a few segment and approach factors. The country’s approximately 3% stop price, at the same time as raised, is following past episodes of work snugness (like 2017-18), while the U.S. Charge is at a chronicled high. This proposes that the neighborhood work marketplace isn’t as of now solving as quick because the U.S. Usually speaking, which might lower the drag on improvement in the close period.